A public/private jobs program to reduce methane emissions now, plug existing inactive wells and create a new program to prevent orphan wells in the future

Summary: Most agree that the orphan well problem needs to be fixed now, but what about preventing additional wells from becoming orphaned in the future? Proposals in Congress address the current orphaned well problem, but they fail to consider the long-term issue of preventing wells from falling into orphaned status in the first place. To do so, Congress simply needs to build upon the successes achieved to date with current orphaned wells and expand the scope to include public-private partnerships to reduce the number of idled (inactive) wells that could become orphaned. Further, states must reform their requirements for operators to provide financial assurance to cover retirement obligations on all new and existing wells.

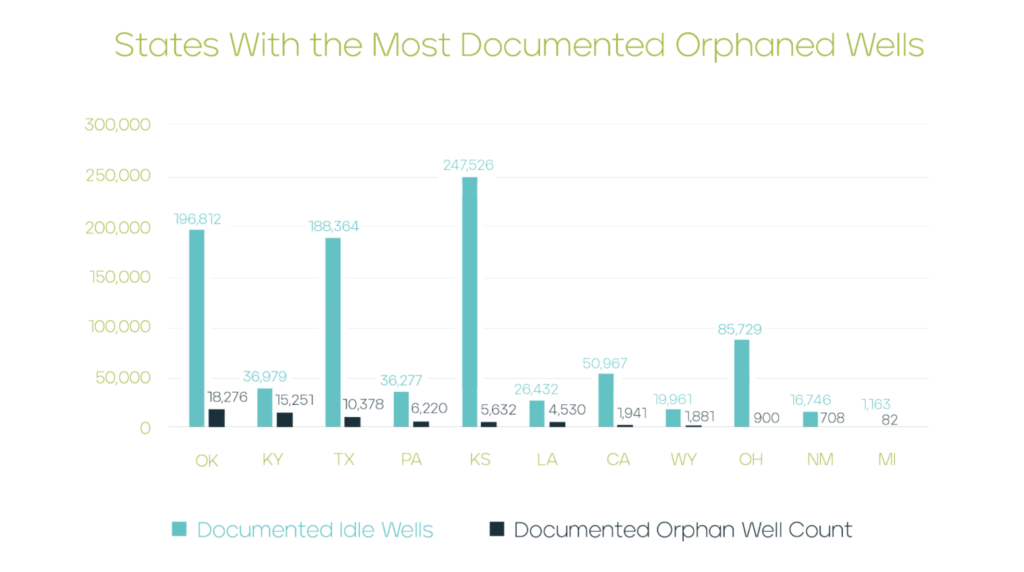

Background: As of September 2021, DrillingInfo reports more than a million inactive wells. To date, the States, and thus the general public, assume the environmental and financial liability for every orphaned well. Often, these wells remain inactive for decades. As of 2018, State orphan well programs reported plugging costs ranging from $3,667 to $97,626. Assuming the average cost reported cost of $18,940, State governments are looking at a financial liability of $18.9 Billion dollars (Source).

In total, DrillingInfo reports over 2,500,000 unplugged wells in the United States (both producing and non-producing) and 20,000 to 40,000 new wells drilled annually. While these wells have the potential to become a liability for the state, they still belong to an operator, which provides an avenue to address the potential problem. Creating a program to incentivize operators to plug and abandon these wells would go a long way to eliminate future orphaned wells that would burden the taxpayer and pose a risk to the environment, health, and safety. Further, requiring companies to provide financial assurance to cover the cost of asset retirement obligations is the only way to directly prevent the number of orphan wells from growing. This should be done immediately on new wells and phased in for existing wells.

Why Care About Orphaned Wells: Inactive oil and gas wells emit a massive and unknown amount of fugitive methane emissions and have potential to contaminate subsurface aquifers, soil and waters of the United States. The EPA estimates that unplugged wells release roughly 280,000 metric tons of methane each year (Source); however, the true volume of methane emission has yet to be measured. Methane is 34 times more potent than CO2, and emissions of methane from unplugged wells create immense health, safety and environmental problems. Our families and our children will have to deal with the repercussions of climate change, and unless a public/private solution is developed, they will also be saddled with the cost to plug these wells.

State Funding of Orphan Well Cleanup: States are liable for orphaned wells, including the proper plugging and surface restoration. Orphan well programs are typically funded by bonds, permitting fees, and/or a conservation tax. These programs have very different results in different states. From 2016-2020, Pennsylvania plugged only 59 out of their 8,000+ orphan wells. In contrast, Texas plugged over 6,800 wells in the same time period, yet Texas’ orphan well count was only reduced by 77 wells from 2018-2019, indicating that wells are continuing to fall into orphan wells status[1].

Currently, bonds cover less than 5% of expected asset retirement funding requirements in most states. Bonds do not designate a party responsible for the act of plugging and abandonment nor do they fund the actual plugging and abandonment. Bonds can only be collected by a State once a well has been classified as an orphan (i.e. no solvent operator) and plugging work has been performed, thus creating a funding gap for the State, which can pose significant financial challenges to States with a large number of orphan wells. For an operator, bonds represent cash that is not readily available to cover plugging costs; therefore, increased bonding will likely only further encourage operators to abandon (orphan) their wells to the State prior to properly plugging them. Increased bonding only further expands a burdensome legal process, rather than encouraging P&A best practices, as evidenced by the fact that the inventory of unfunded inactive wells has been building for over a century, even with bonds in place.

Orphan well funds exist to address liabilities left to the state; however, they will do nothing to stem existing wells from becoming orphaned.

Federal Funding of Orphan Well Cleanup – The REGROW Act:

Funds in the Infrastructure Bill will assist with the plugging and abandonment of existing orphaned wells in the US. The REGROW Act, which became part of the bipartisan infrastructure package, would provide for:

- $4.275 billion for orphaned well cleanup on state and private lands.

- $400 million for orphaned well cleanup on public and tribal lands.

- $32 million for related research, development, and implementation.

How to Stop the Number of Orphan Wells from Growing:

Expand the REGROW Act to include $2 billion of funds for existing idle wells through the creation of a public-private partnership that incentivizes operators to commit to reducing their idle well inventory, employ best practices for plugging and abandonment, and provide financial assurance for future asset retirement obligations.

- Cap the number of wells that can become orphaned: States that receive funds from the expanded REGROW Act must modify regulations to require financial assurance to cover the cost of future asset retirement obligations for all new wells. This will limit the potential number of orphan wells to the current inventory of approximately 2,500,000 active and inactive wells.

- Reduce the existing idle well inventory by 20%: Apply the ranking criteria identified in the REGROW Act to idle wells and allow states to allocate $2 billion from the expanded REGROW Act available to private companies to cover 50% of the cost to plug idle wells to prevent them from becoming orphaned in the future. (Assumptions: 1 million active wells in the United States, average cost to plug of $20,000.)

- Ensure existing wells do not become orphaned in the future: Require states to modify regulations to require operators to phase in financial assurance to cover the cost of future asset retirement obligations for 100% of their non-plugged wells (active and inactive). Through the expanded REGROW Act, incentivize operators by offering a governmental guarantee to help fund financial assurance programs for operators who cover at least 10% of their wells in the first year.

Expanding the REGROW Act to immediately eliminate an additional 200,000 idled wells would permanently eliminate significant emissions and associated environmental, health and safety liabilities. In addition, a cost sharing program incentivizes private industry participation, ensuring the government doesn’t have to shoulder future, and potentially larger, environmental liabilities.

1. Orphan well plugging counts from TX and PA were provided via email. Orphan well counts taken from 2020 IOGCC report (source).